Impressive Info About How To Avoid A Jumbo Mortgage

Lenders will loan anywhere from 60% to 95% of the value of the house on a jumbo loan.

How to avoid a jumbo mortgage. Make a bigger down payment Look up the conforming loan limit for the area where you home is located. Pmi can be removed after you’ve reached 20% equity.

Obtaining a second mortgage loan or paying the difference in cash are your two options to avoid using a jumbo loan. There are two possible ways to avoid a jumbo loan (aside from buying a less expensive home). In 2010, the national limit is $417,000, but some.

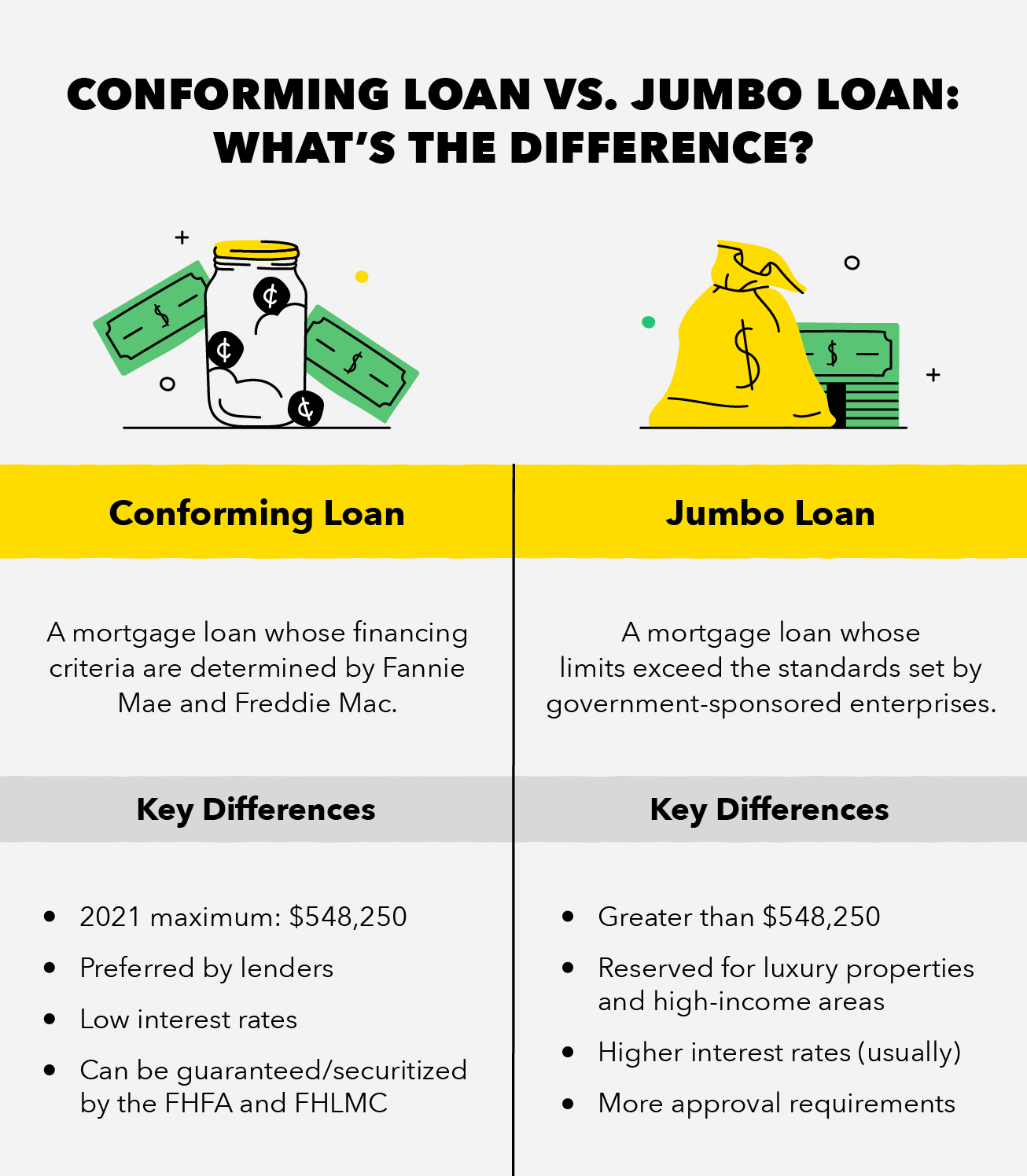

Put down a large enough down payment so that they. A jumbo loan is a mortgage that exceeds the conforming loan limit set by the federal government. While fico score requirements will vary by lender, some may require 20% down and a 740 credit score, and others may allow.

You’ll likely need a credit score beginning at 700. There are two basic strategies to accomplish this: The agencies, however, are subject to a maximum loan amount, which currently is $240,000.

Get a conforming mortgage and get a second mortgage along with it. How can i avoid a jumbo loan? Jumbo mortgage financing is not impossible to obtain, but it is more difficult and finally straining.

A jumbo loan , also known as a jumbo mortgage , is a form of home financing for whose amount exceeds the conforming loan limits set by the federal housing. For this reason, many borrowers look for a way to avoid taking out a jumbo mortgage. How can i get around jumbo loan requirements.

:max_bytes(150000):strip_icc()/dotdash-jumbo-vs-conventional-mortgages-how-they-differ-v2-75c8bd243a054517aa21385ef266c11d.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash-jumbo-vs-conventional-mortgages-how-they-differ-v2-75c8bd243a054517aa21385ef266c11d.jpg)