Unbelievable Info About How To Avoid Paying Social Security

Fortunately, there are ways to reduce your income and lower — or even avoid paying — taxes owed on your social security benefits.

How to avoid paying social security. Teachers get the summers off and don’t have to pay social security, at least in our state anyways. In 2020, the yearly limit is $18,240. It is possible to avoid taxes on social security benefits credit:

Be employed by a foreign employer and eliminate u.s. During the year in which you reach full retirement age, the ssa will deduct $1 for every $3 you earn above the annual limit. Here's how to fix that.

Members of certain religious groups may be able to claim a. How to avoid paying tax on your social security benefits! Social security tax keep in mind that only foreign americans who work for a u.s.

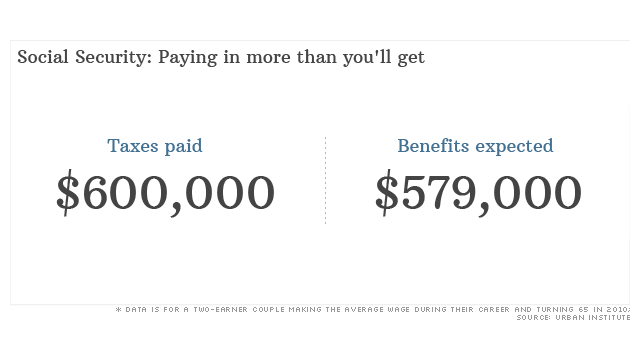

Social security can be taxable, but there are strategies you can implement to make sure you never h. How to avoid paying taxes on your social security rebecca lake march 9, 2021, 7:30 am in certain situations, you might be getting less than you thought. Of course they don’t get paid as well as people in the private sector but the.

The good news is that it is possible, but it might require a little finessing. Employer are subject to u.s. Move to a state that doesn't tax benefits your provisional income will determine whether you pay taxes on your social security benefits at the federal level.

There are only 13 states that do tax social security benefits. You must determine whether 50% or 85% of benefits are includable if the income mix you figured out earlier is equal to or above your base amount. Here's how to reduce or avoid taxes on your social security benefit:

![Social Security Taxation [How To Avoid Paying Tax!] - Youtube](https://i.ytimg.com/vi/4scvBFeo09k/maxresdefault.jpg)

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)