Beautiful Info About How To Be Head Of Household

A husband’s role in a family is to lead his wife and children to god.

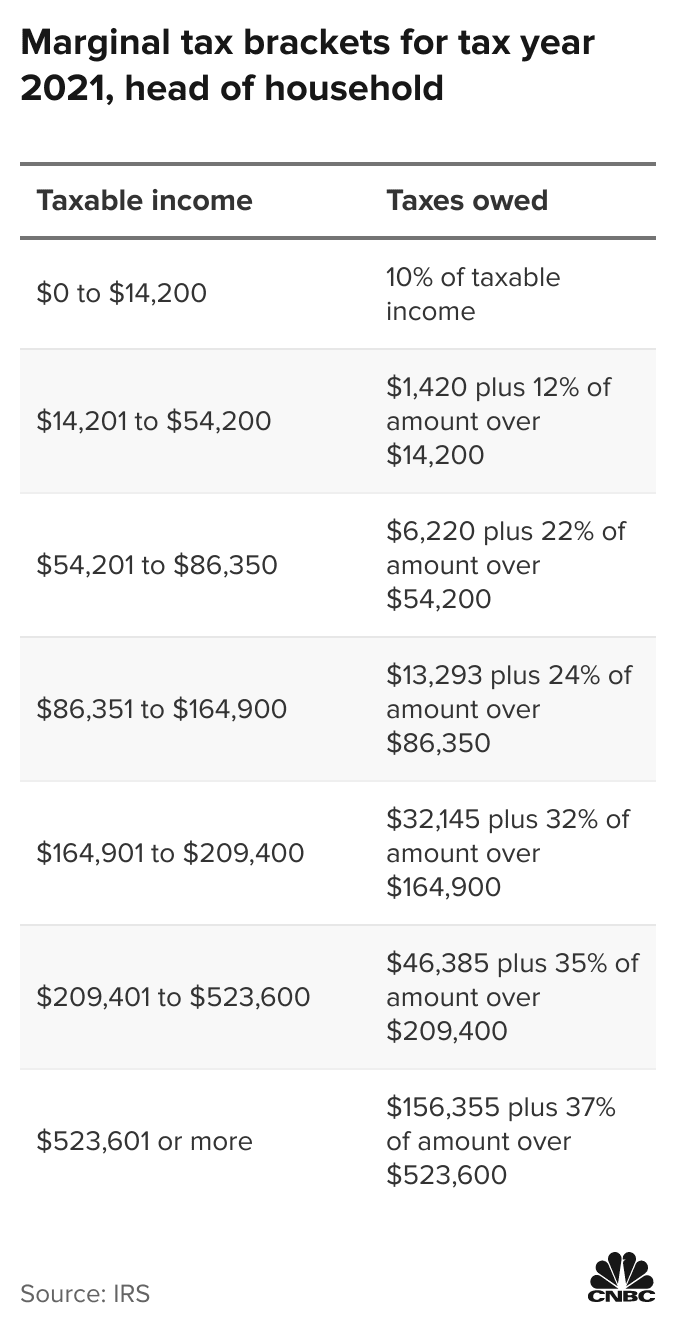

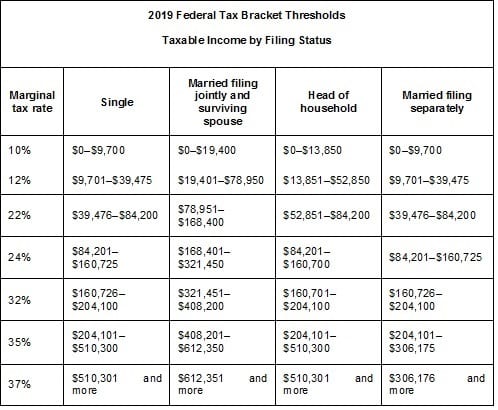

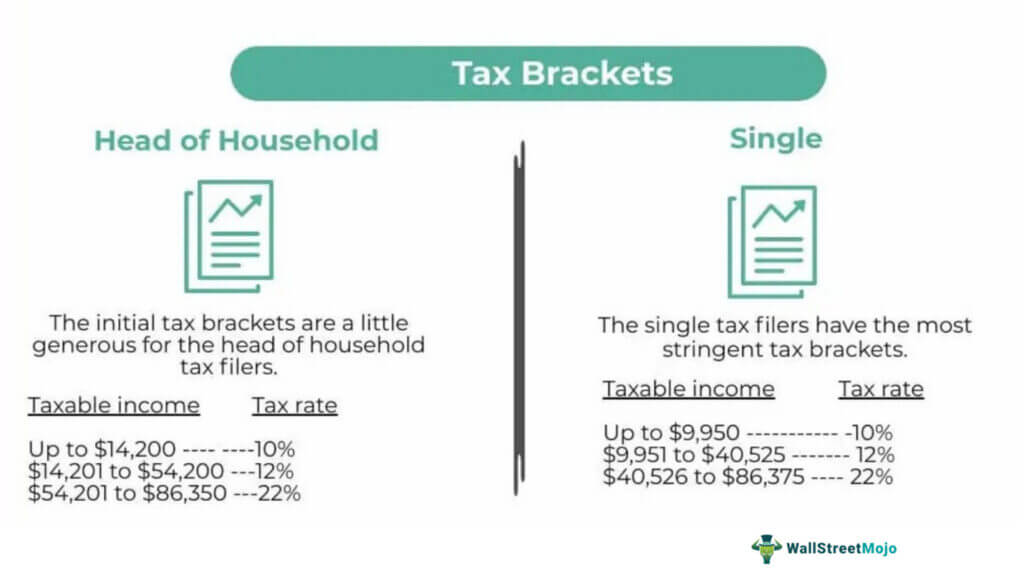

How to be head of household. But to qualify, you must meet. Once you’ve established that you paid more. Head of household (hoh) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single.

Head of household must be paying for at least half of household expenses in order to qualify. How much do you get back for claiming head of household? (rent, utilities, groceries, etc.) should live with a qualifying member of the.

Not only did we get that ameerah blindside, but that’s the week the leftovers formed. You have to qualify for head of household. As far as the children are concerned, a mother and father working together are the heads of the household.

Take stock of the major expenses for your household and start doing some math if. From that moment on, the final four was installed,. You were unmarried or considered unmarried on the last day of the tax year;.

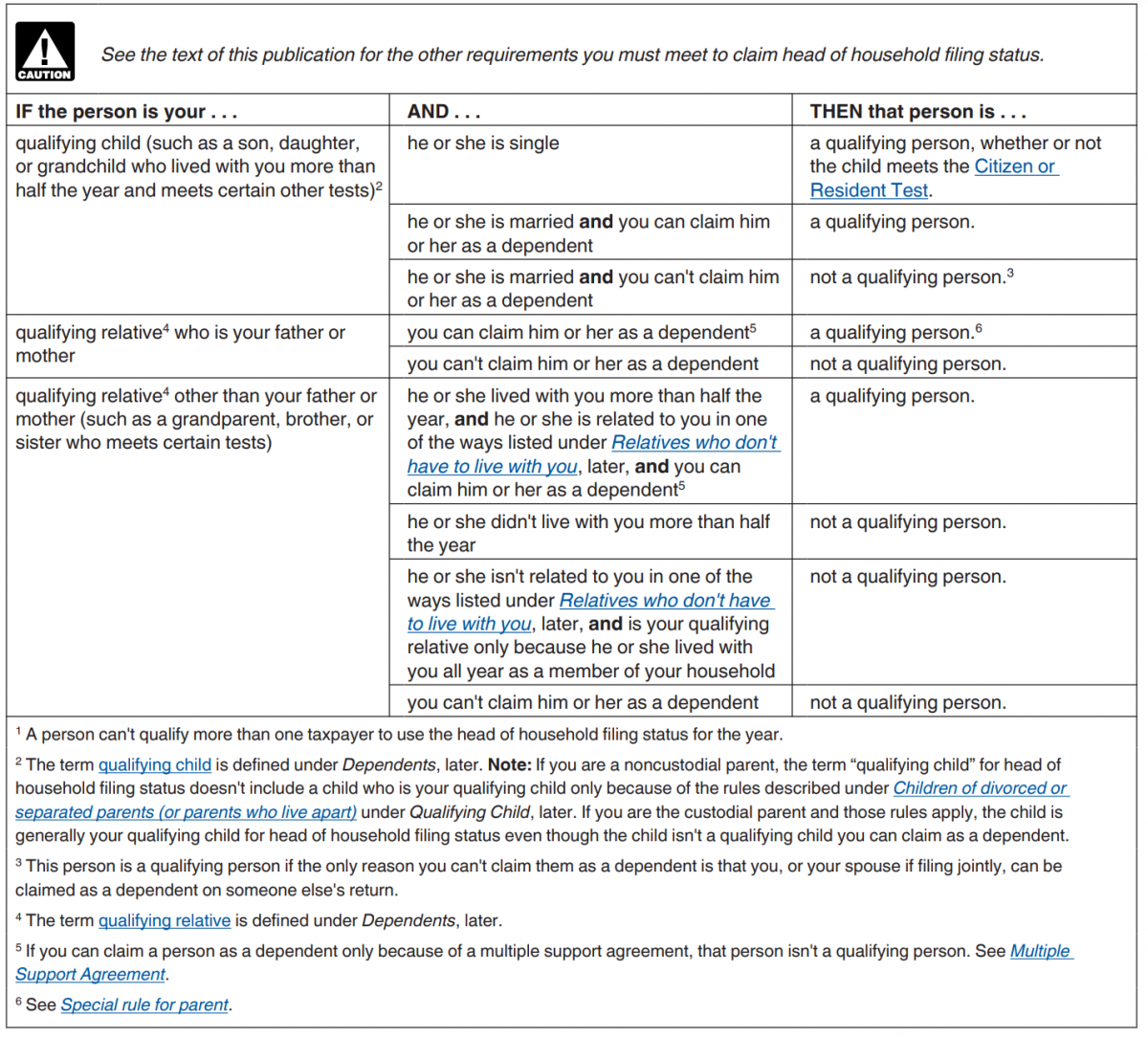

For a taxpayer to qualify as head of household, he/she must be either single or unmarried at the end of the year and have maintained a home for a qualifying person such as. No, only one parent may claim the child as a qualifying child to file as head of household. Who is a qualifying person qualifying you to file as head of household?

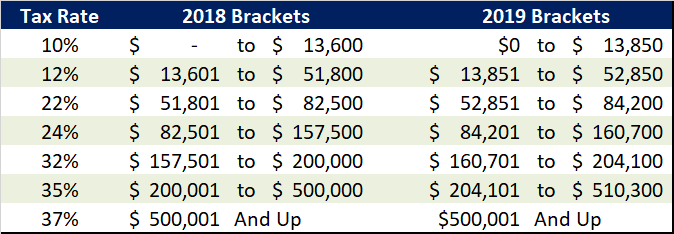

Three basic rules determine if a taxpayer qualifies for the head of household filing status, and you must meet all of them. Definition of head of the household. Head of household deductions and exemptions if you're single or a married person filing separately, for 2019 your.

:max_bytes(150000):strip_icc()/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png)