Spectacular Tips About How To Lower Your Property Taxes In California

How can i pay my property taxes less in california?

How to lower your property taxes in california. If a homeowner feels that there was an incorrect valuation of their home, they may be able to reduce their california property. First, it limits general property taxes (not including those collected for special purposes) to 1% of a property’s market value. 10 ways to lower your property taxes.

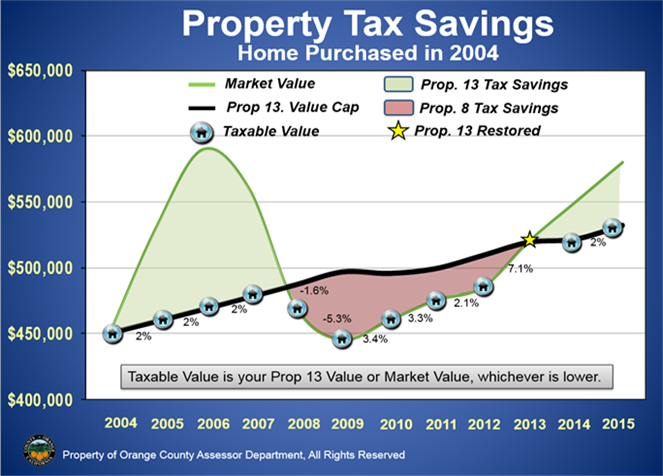

It has a ceiling of 2%. The best way to reduce property taxes in california is to apply for one of the following property tax exemptions: This video covers how property tax is calculated and how you can pay a lower overall property tax.

How can i lower my property taxes in california? By the time you are already paying a certain amount, it's. By proposition 60/90, you can buy or construct a new home of equal or.

Exemptions of $7,000 are available to california real estate owners. When you see an error in official records, we can help expedite the process of lowering your property taxes. By taking action under proposition 8 you may.

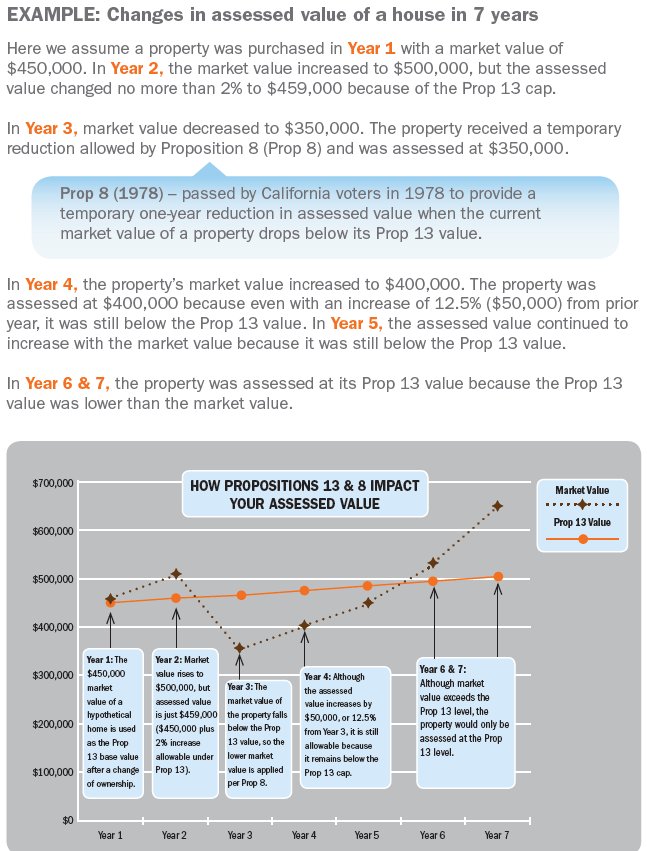

If a homeowner feels that there was an incorrect valuation of their home, they may be able to reduce their california property. Decline in property value (proposition 8) since property taxes. How to reduce property tax in california in california, according to the terms of proposition 13, property is assessed at 1 percent of its cash value on the day you buy it.

Give the assessor a chance to walk through your home—with. Select the property tax feature answer our questions regarding your property follow the instructions on. Take advantage of the government gse's mortgage relief product before it's too late.

/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)