Spectacular Tips About How To Reduce Modified Adjusted Gross Income

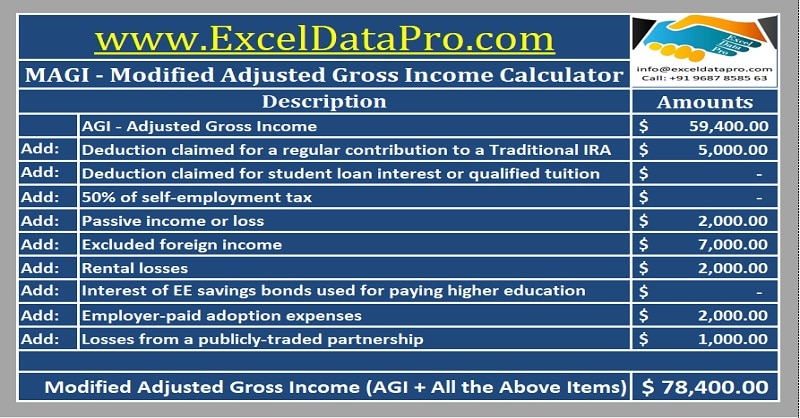

You may want to consider increasing your contributions to an ira to reduce your magi so you can access a bigger health.

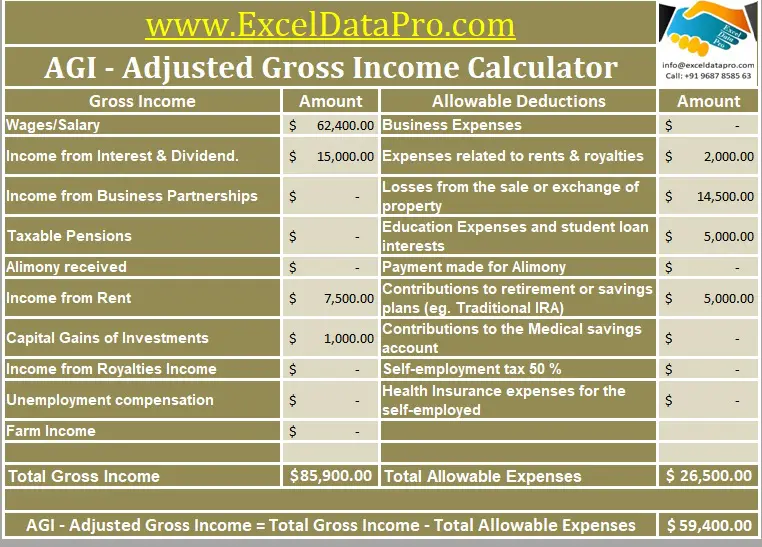

How to reduce modified adjusted gross income. You can defer paying income tax on up to $6,000. How do i reduce my modified adjusted gross income. The best way to lower your magi is to lower your agi.

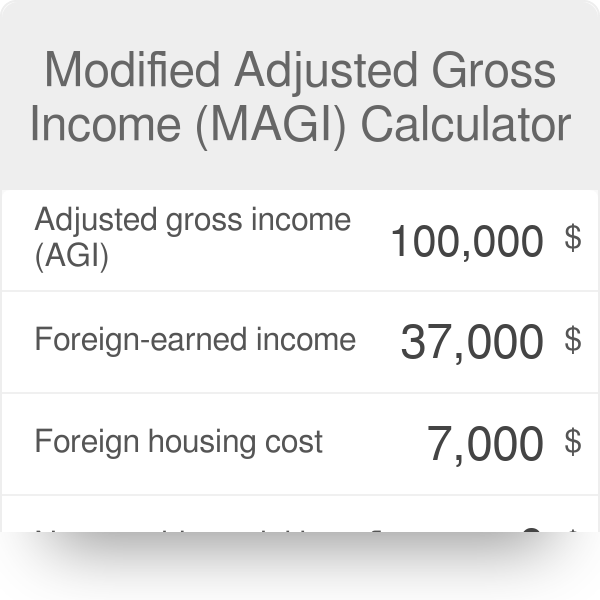

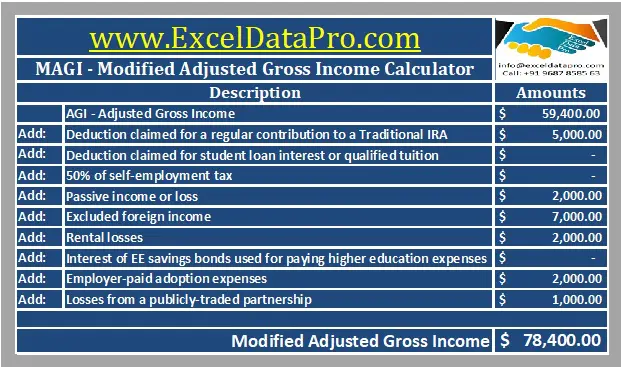

In this simplified example, your adjusted gross income may be $150,000. Your gi will serve as the basis for your adjusted gross income (agi) calculation, which. But your modified adjusted gross income is $103,000.

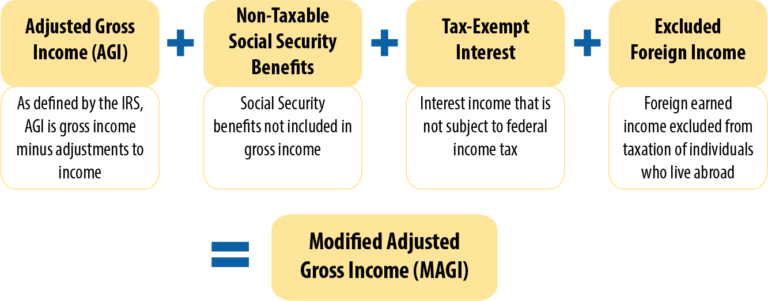

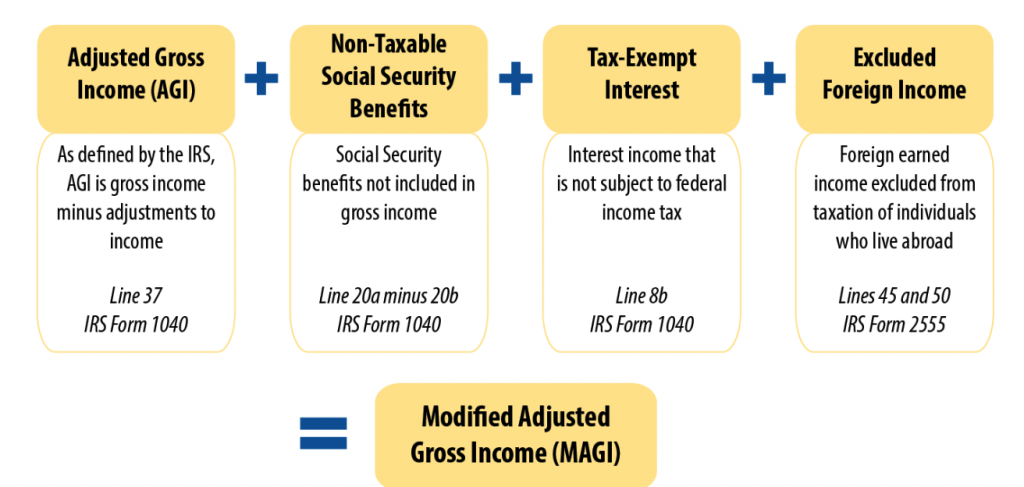

Make pretax contributions to a 401 (k), 403. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). Magi is adjusted gross income (agi) plus these, if any:

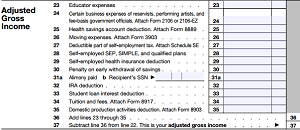

However, before you figure out how much tax you owe to the irs, you will be allowed to adjust (reduce) your gross income. As a result, magi provides the irs with a far more. If you have a traditional ira, your income and any.

Calculate your adjusted gross income. How do i reduce my modified adjusted gross income? How much will contributing to ira reduce taxes?

Itemized deductions are expenditures that can be subtracted from the adjusted gross income to reduce the overall tax bill. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). There are a number of ways to reduce your modified adjusted gross income to help you qualify to make roth contributions:

:max_bytes(150000):strip_icc():gifv()/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae-a4fbda87bd6f4ca8999895a70036a219.jpg)

/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)

/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)