Painstaking Lessons Of Tips About How To Reduce Principal On Mortgage

Here are some ways you can reduce how much you owe on your mortgage.

How to reduce principal on mortgage. When mortgage rates drop, contact your lender to lock your rate. To put it into perspective, the monthly. Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term.

The mortgage rates trend continued to decline until rates dropped to 3.31% in november 2012 — the lowest level in the history of mortgage rates. Just make the first payment of $900, the second payment of $901, and so on. For hamp modifications that include a pra principal.

Another way to get a lower rate is to buy down your. You might cut the length of your mortgage by eight years if you. Pay extra each month on your principal.

The monthly mortgage payment, 6% of $200,000, is $1,199. It also helps you avoid paying extra on mortgage since mortgage insurance. If you can pay an extra.

Funding at least 20% of the downpayment is often enough to get a lower home loan interest rate. Look for rates that are lower than your current interest rate. To recap, here are 9 ways you can lower your monthly mortgage payment — with or without a refinance:

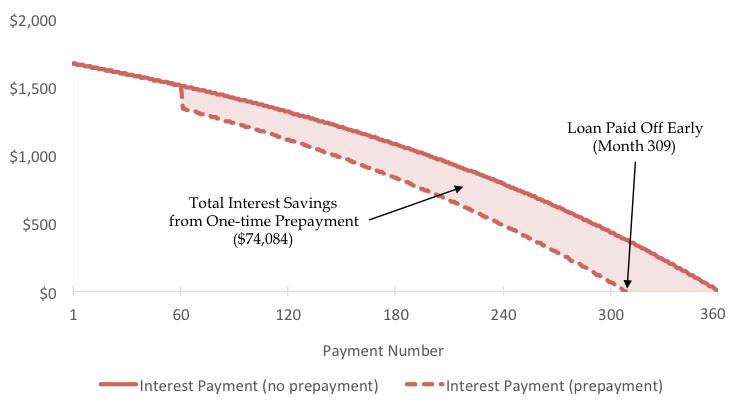

Round up your mortgage payments. Making a lump sum payment toward your mortgage will decrease what you owe and save money on interest. A lender may grant a principal reduction to provide financial relief for a borrower as.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-02-d54b2295a00646f5b046571b0f099aad.jpg)

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)